| Posted by Brian Fletcher on 28/09/2018 | 0 Comments |

Upside targets for the S&P 500.

Don't overstay your welcome.

Alternative investment ideas for when the downside comes.

My August 31st article urged investors to NOT lose their core long positions because the S&P 500 was breaking out. I went on to describe what constitutes a breakout, both from a support and resistance perspective and that of a traditional Elliott Wave Perspective.

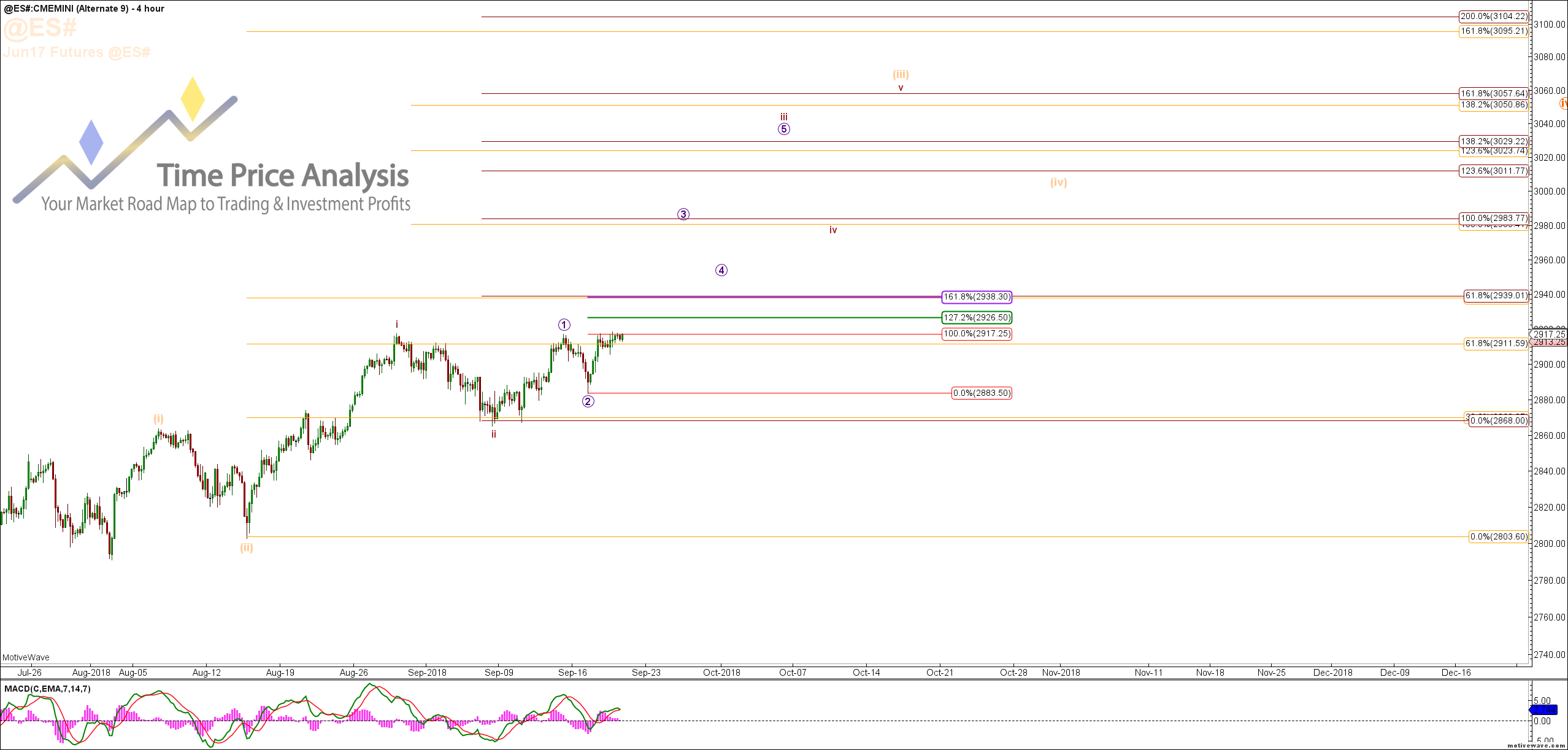

In this article, I'll describe upside targets, and another investment alternative that can be held through the impending downside - that we're expecting - after this upside concludes.

Our ultimate upside target for the S&P 500 is 3,231 to 3,346, which is over the 2.0 and 2.382 Fibonacci extensions, respectively, off the 2009 low. See the daily chart below, where overall wave 4 of the move off the 2009 low was established as a running flat in April of this year. Since then, SPX has formed a diagonal wave i, and a picture perfect wave (I) to the .618 extension - the most common extension for wave (I). This setup is a classic Elliott Wave i ii (I) (II) setup to the upside, such that once the index broke over the top of wave (I), as it did in late August of this year, it set into place the potential for a slow grind higher.

Naturally, there are other possibilities, but until prices break back below the .618 extension, or 2,850, there's no reason to consider stepping aside in equities until they reach, at a minimum, the 3,121 level. In layman's terms, there is an additional 15% of upside remaining, and while stock prices might seem frothy, having broken out to the upside, the grind up is just beginning.

Because this is the 5th wave of the 3rd of the super cycle wave iii, we will not overstay our welcome, and while we will take advantage of the last and final move higher, we'll be looking to exit our core holdings in the SPX 3,150 region.

Upon completion of this move up, we expect an 18-month correction that will take the S&P back down to the 2,400 to 1,800 region, which is not a time for equity exposure. We recommend exiting most equity positions and awaiting an opportunity to re-enter from much lower levels. That said however, our expectation is for continued upside through to the first or second quarters of 2019 before exiting core holdings.

One of the approaches we are taking as the S&P comes into its multi-month high is to identify sectors that offer lucrative opportunities...read the rest of this article at Seeking Alpha.