| Posted by Mike Richards on 04/04/2018 | 0 Comments |

In my last article – (Wish List of Stocks for S&P500 Move to 3,200), I provided a small list of the many companies we have identified for our subscribers that will significantly outperform the S&P500 in its anticipated move up to the 3,200 region later this year.

While in an era of Bitcoin and FANG stocks, Walt Disney Company (SYM:DIS) may not seem like the most glamorous stock to own, insomuch making huge profits are glamorous, Disney way more than qualifies, and given the right entry into the stock, affords investors a rare opportunity indeed.

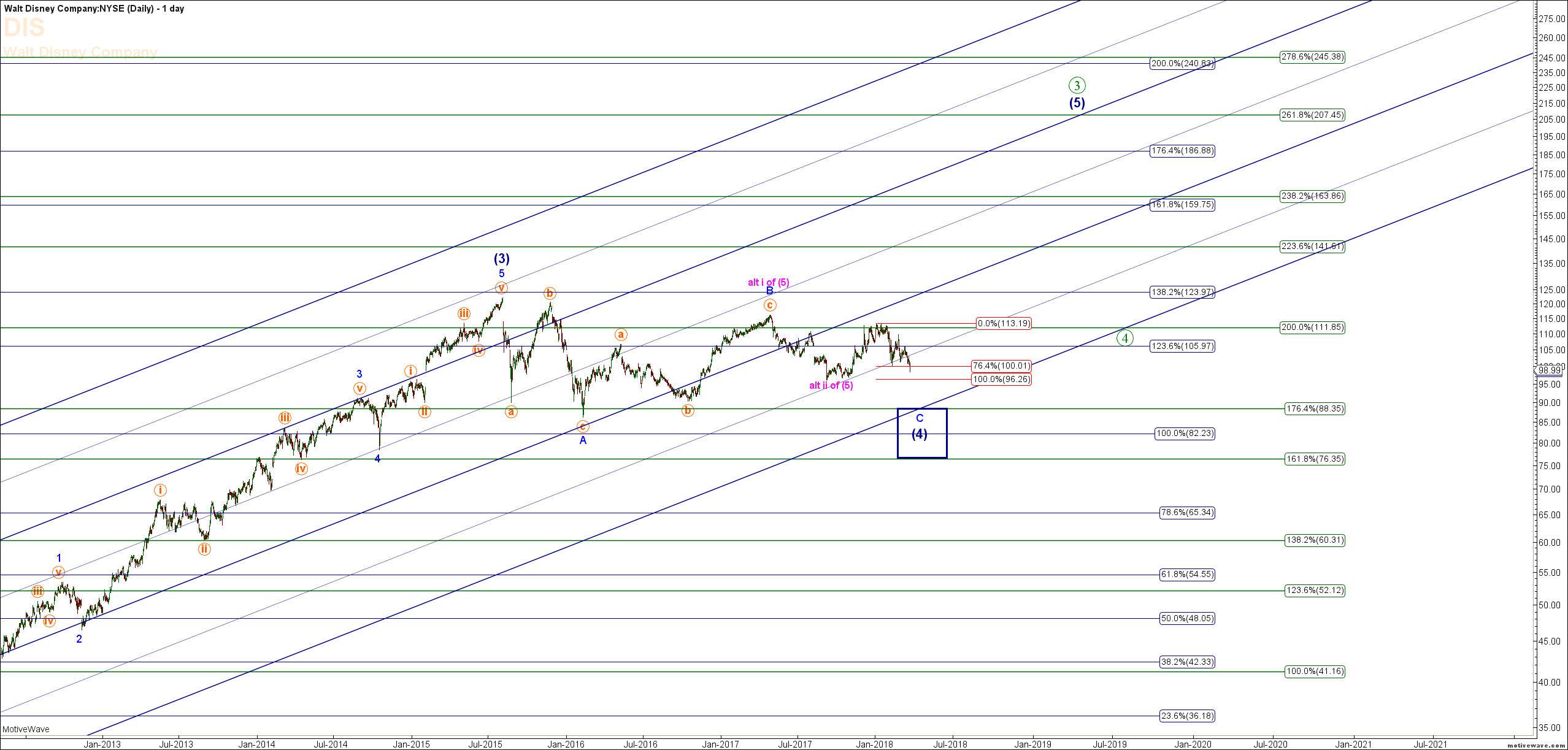

From a pure Elliott Wave structure and Fibonacci extension perspective, Disney’s adherence has been picture perfect in its pattern and measurement’s off the 2009 low, which makes for a highly reliable entry and price level forecast. Moreover, based on our Hurst Cycle and Elliott Wave analysis suggesting a move higher in the S&P500 into later this year, Disney is setting up to offer investors an opportunity to significantly outperform the indices.

Presently Disney’s Elliott Wave structure suggest it’s in a miner degree 4th wave, with a price target of $76 - $88, with a possibility it holds the $93 level. We are recommending our investors accumulate shares in these price regions with an expectation of a move up to $207, or an expected return of 159%.

While I won’t espouse on the fundamental aspects of what could cause such an enormous move up in Disney shares, I will say this is a very realistic expectation for Disney shares, as it tends to outperform in bullish markets. To provide some perspective, Disney shares hit a low of $15.23 per share in 2009. Presently their shares are selling for $97.77, or 6.42x their 2009 low. Had the S&P500 performed similarly to Disney in the same timeframe, it would presently be at 4,275.

We will be patient and seek the right entry into Disney, but it’s important that each investor has their own plan to allocate capital to individual stocks during this correction, and presently Disney offers significantly more upside than downside, and significantly more upside than the indices and many other individual stocks. In addition, once market indices actually do conclude their Primary degree (3) later this year, Disney may offer investors continued upside during the initial stages of a larger corrective move lower in the indices.

Why not buy some shares of Disney and let the profits and let it fund your next Disney World adventure!