| Posted by Brian Fletcher on 09/07/2018 | 0 Comments |

Whether you’re an active investor who manages their investment capital for exceptional performance, or a trader who seeks to generate weekly and monthly profits, natural gas is a phenomenal tool to help you to achieve your goals.

There are a number of ways to trade in Natural Gas – ETF’s (i.e. UNG), leveraged ETF’s (i.e. DGAZ and UGAZ), and Natural Gas futures. While we trade NG futures on a daily basis in our live trading room, our active investor subscribers are up an astonishing 38.74% thus far in 2018 in NG, resulting from only 4 individual trades lasting an average of 2 weeks each.

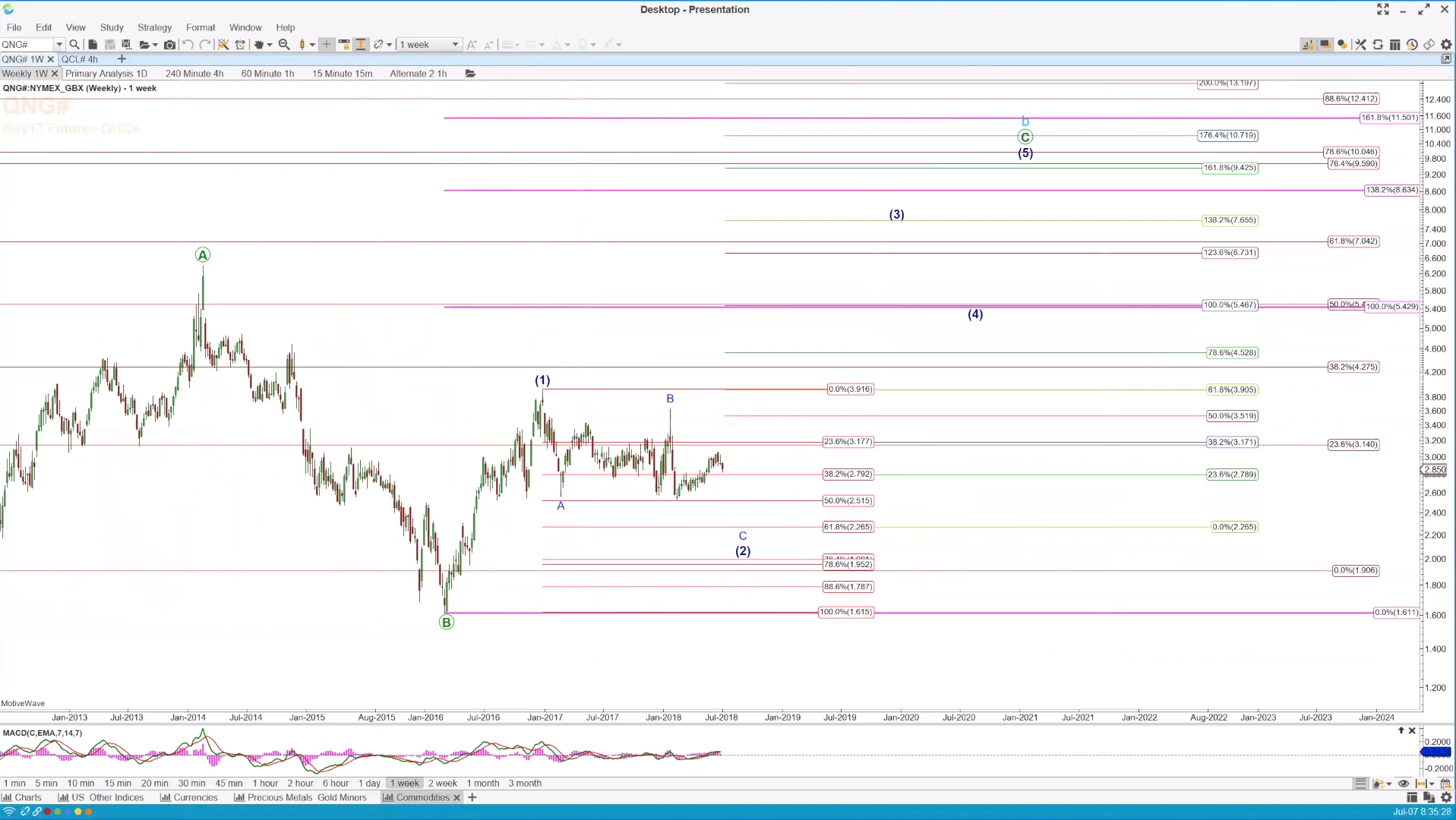

What makes NG so attractive for active investors and traders is the adherence it demonstrates to its long term Elliott Wave count. Adherence to an Elliott Wave pattern can provide low risk and high reward scenarios. Allow me to explain by reference to the above weekly chart.

In this discussion I’ll focus on the intermediate to long term expectations, but will ignore the super cycle analysis, very long term expectations, as from an investor or trader’s perspective, the time frame between now and 2021 is all that is relevant. Presently NG is completing a C-wave of (2), with a price expectation for a drop from its current level of $2.85 to $2.265 in the coming 2-4 months. That’s a drop of 21% in NG, which translates into a potential gain in shares of DGAZ of 50-60%. Because the move down will occur in several stages, or wave structures, we do not recommend investors simply purchase shares of a leveraged ETF and hold for the entirety of the move. That being said though, there are a minimum of two low risk and high reward trades expected to occur in the coming 3 months, with a multitude of upside trades to occur in the coming 2-years after.

Upon completion of (2) to 2.265, our expectation is for an enormous move up to the $10 region to occur in the coming 2-3 years. This is a four-fold increase in NG that will allow investors to capitalize on a multitude of trades resulting in exponential performance in one’s underlying capital. Simply taking a long term position in UNG upon the completion of the downside is one approach. Another approach for more active investors is to use shares of a leveraged ETF – UGAZ in various trades for the move up from 2.265 to $10, allowing them to capitalize even more.

Investors are either passive or active. An active investor is one who focuses on the consistent re-allocation of portions of their investment capital into areas that enable them to compound at much higher rates of return. Passive investors are content with a diversified investment allocation approach. Active investors become students of various instruments, markets, and services that afford them the ability to compound their capital more rapidly, thus enabling them to achieve their long term investment objectives much more swiftly.

If you are an “active” investor, NG is an area to routinely focus some amount of your time and energy, as from a purely Elliott Wave perspective, it’s adhering to our long term chart pattern such that we intend to partake of a number of very attractive scenarios setting up over the next 2-3 years.