Since 2012, I’ve diligently followed the work of certain analysts who provide Elliott Wave Analysis for this sector, and the story of the little boy who constantly cries wolf is what comes to mind. The other story that comes to mind is that if you stand on the beach anywhere on earth and say the tide is coming in, sooner or later you’ll be right, and can therefore make the claim of accuracy in your forecast. Unfortunately, if you were one who followed this analysis, it’s been hazardous to your account.

It started with the pull back that occurred off the August 2016 high, which initially concluded into September, 2016, where in Elliott Wave parlance, was charted as a wave 2, in a i ii 1 2 setup, thus looking for metals and miners to go to the moon, and then continued by calling a low on every small rally that occurred during the range bound consolidation that took place over the last 12-months.

We’ve accurately projected the current pull back for well over the last year, and while many others repeatedly cried wolf, we’ve been patiently waiting for the sector to come into our “entry” cross hairs. In this article I’ll discuss the buy zones for the metals and miners sector, the potential upside, the general fundamentals of individual miners, and our strategy for helping investors seek enormous profits in a relatively short span of time.

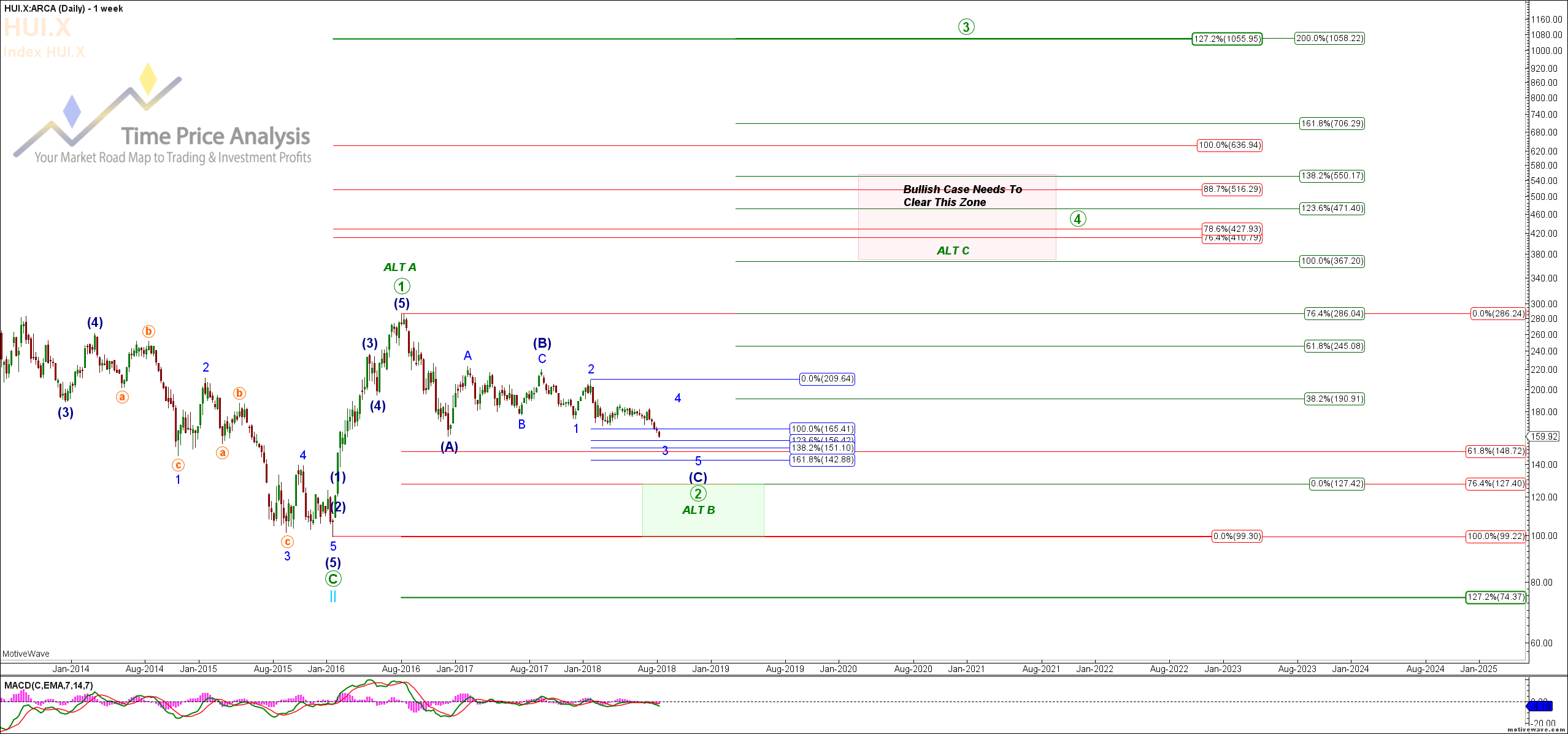

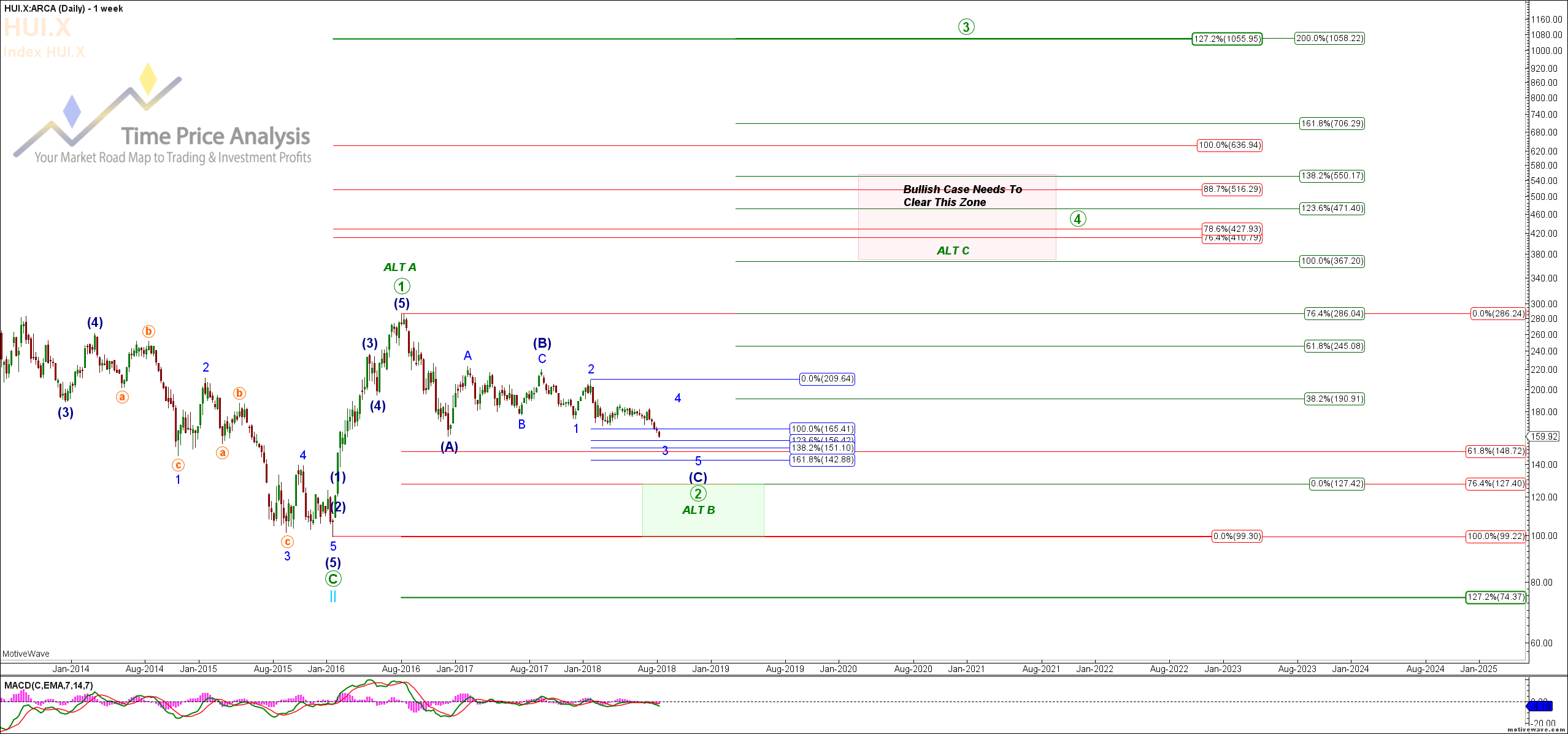

Opportunity and Buy Zones for HUI, GDX, and Gold

Let’s start by looking at the buy zones and potentials for upside in the HUI Goldbugs Index, GDX, and Gold. In the last 12-months, the market for gold and miners has given us some great clues about what to expect in the next 12-18 months. We first consider the technical aspects before breaking down the individual mining stocks to determine those that have the strongest fundamentals.

Our key technical approach is Elliott Wave Analysis. Clearly, from an Elliott Wave standpoint, the move off the January 2016 low was an impulsive structure consisting of 5 waves. What this tells us is that after a pullback we can, at a minimum, expect another 5 wave move of similar size or greater.

The question then becomes will we only see a similar sized move, or a much larger wave 3. In English, once metals bottom in the coming 1-4 months, will the next move higher be the same size as the one that occurred in 2016, or will it break upside resistance in a massive 3rd wave?

I would contend that from a pure investor’s perspective, at this time it doesn’t matter, as the entry for either is similar. Even if the smaller of the two possibilities occurs, we’re looking at the opportunity to enter GDX in the $15.50 - $17.78 region for a ride to $45.51 - $67. Furthermore, we would expect this move to take no less than 8 – 18 months to complete.

Furthermore, we view the consolidation that occurred in the last 12-months as a b-wave triangle. The significance of this is that b-waves virtually always result in a conclusive move to the direction they resolve. In this case, the b-wave triangle consolidation resolved to the downside, suggesting that once the downside resolution completes, it will setup a massive move higher. While gold has a somewhat different pattern to that of GDX and HUI, the upside is enormous.

Price targets for Gold are in $1,150, $1,124, or $1,115 to the downside, with minimum upside price targets of $1,666 - $1,924. Once gold puts in a low and commences its move higher, we’ll be better equipped to provide more accurate forecasts based on the initial structure of the move off its low.

The HUI Goldbugs Index offers great insights into when and at what price levels to position into individual mining stocks. While we look at each miner’s chart and fundamentals individually to ensure the optimal entry, the HUI can provide great clues. Our expectation for HUI is a drop into the 127.42, or a double bottom at 99.30, followed by a move up to a minimum of 367 – 550. This is synonymous to our forecast in GDX.

So, as you can see the opportunity is setting up, and while others have repeatedly cried wolf, we’ve been very patient for the larger patterns to unfold. What’s disconcerting, and quite real for many investors, is that by the time this sector actually does provide a tradeable low, many investors will have experienced such enormous losses from buying too early, that they’ll decline to participate when the opportunity really does exit (the wolf really is on the perimeter).

Miner stocks are inherently volatile, and buying too early for a ride in the opposite direction can cause investors to experience 50% to 75% drawdowns in their positions. Taking these types of drawdowns doesn’t exactly encourage adding to positions from lower levels. (Check out our video to see our targets in more detail.)

Forming a Strategic Portfolio Approach to the Miners Sector

There are over 1,000 publically traded miners worldwide. Once you exclude those companies that are either micro-cap and/or have such low volume one wouldn’t want to buy them, the number drops to less than 250. I’ve seen investor portfolios comprised of over 70 different mining stocks. Firstly, if one does their homework on the fundamentals candidates from within the sector, there is absolutely no reason to own 70 stocks. This is virtually impossible for an individual investor to track the fundamentals and technical for each company, and renders the ideal of carrying an appropriate level to stop out, or exit each position and impossible task.

There are three ways to most effectively capitalize on the next move up in the mining sector – 1. Own a small portfolio of 8-12 miner stocks that are well vetted fundamentally, and enter at an appropriate buy zone that allows for a tight stop out level, and thus very high reward to risk skew; 2. Purchase shares of a leveraged ETF after the initial completion of an impulsive structure to the upside, with a tight entry stop out level and this high reward to risk skew, then manage this position through the rise that occurs; and 3. Purchase options against key large cap miners after the pull back of an initial impulsive structure to the upside, confirming the low has likely occurred.

Risk tolerance will vary by investor and the amount of capital they allocate to the sector, but we recommend not greater than 10% - 20% of one’s investment capital to this sector. Of the portion of capital one allocates to this sector, we recommend 70% allocation to 8 – 12 individual stocks, 20% to leveraged ETF’s (i.e. NUGT), and no more than 10% to options positions. Practically speaking, what this means is the individual stocks are core holdings that one would hold through the entire move up, while the ETF’s and options would be managed through the move up – exited and re-entered several times upon the completion of portions of the move higher.

Fundamental Aspects of a High Quality Miner

We start our analysis by excluding those companies that have poor liquidity and whose mines reside in unfriendly mining jurisdictions. We then do a thorough analysis of both enterprise value – what we refer to as their franchise cost, and their proven and measured reserves. It’s simply math.

To illustrate, if you were going to purchase the company in whole at their current stock price, that would be the market cap of the company. For this, you would receive all the current assets (cash, inventory and receivables), and you would be liable for their debts (long and short term debts). In simple terms, the enterprise value is the market cap – current assets = all liabilities.

We then take their franchise cost and divide by the proven and measured reserves to establish a cost for each ounce of gold or silver we’re buying shares for. The disparity between good fundamentally good companies vs. those having financial challenges is enormous. This due diligence process provides for a small number of companies to rise quickly to the top.

As such, why develop an unwieldy and difficult to monitor portfolio of 70 companies when you can own a high quality and easily manageable portfolio of 8 – 12 miner stocks?

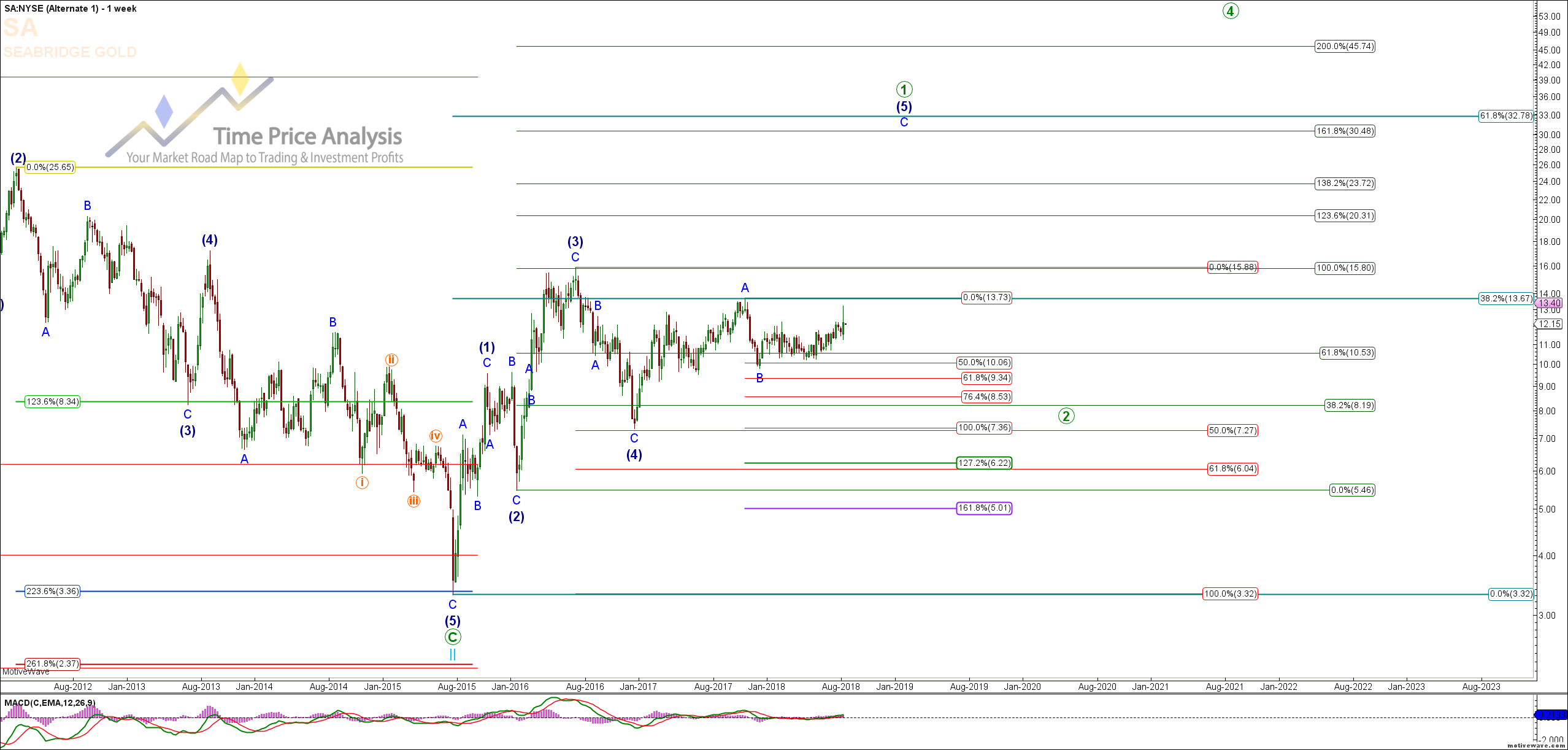

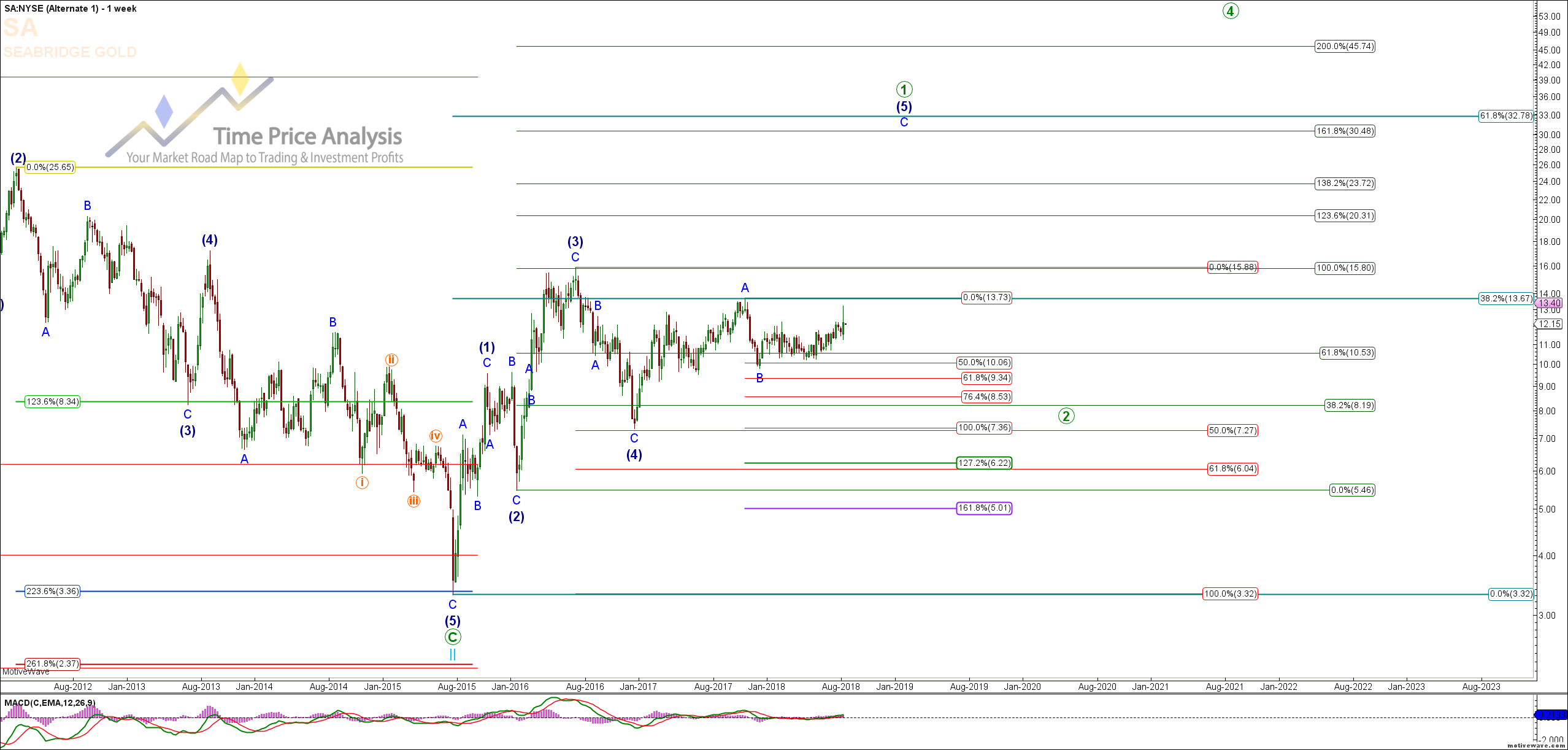

Seabridge Gold

Seabridge Gold Inc. (NYSEMKT:SA) is an example of a miner stock that we like. SA is not a miner, per se, as they are a company that owns enormous proven reserves in a stable mining jurisdiction – Canada. Some people refer to companies like SA as hoarding companies, meaning they don’t mine gold or silver, but rather accumulate fully entitled reserves that can be converted to mining operations in the future. It is not likely that SA will operationally ever mine their gold and silver, but will joint venture with quality mining operators under terms that maximize shareholder value.

They also have the ability to await a sustained bull market in metals before negotiating operator deal structures. Presently, based on an enterprise value of $715M, buying shares in SA is the same as purchasing their proven and measured reserves for a cost in gold of $11.39. Obviously mining is capital intensive, but this is a pure leverage play against the sector.

It should not be a surprise that we anticipate a 3-4x increase in shares of SA in this next move up.

Concluding Remarks

The metals and miners sector is finally setting up for a very nice rally in 2019. Investors should seek to position capital into the buy zones for the HUI and GDX. Furthermore, investors should identify companies with strong fundamentals and excellent upside potential, and develop a manageable portfolio with these companies as the core buy and hold portion of capital they intend to allocate to the sector. Investors can capitalize on the move up by adding leverage in the form of leveraged ETFs and options, but should do so at the appropriate time in the wave structure that unfolds to the upside, thus protecting their portfolio from large draw-down risk.

While this is a great opportunity, it’s not the only great opportunity that exists in financial markets, and we therefore suggest limiting overall exposure to no more than 20% of investment capital.

Stay tuned for later articles on several individual mining stocks we prefer right now.

This article is also published on Investing.com