| Posted by Brian Fletcher on 28/01/2019 | 0 Comments |

The use of leveraged ETFs in the precious metals miners sector can be lucrative, but only as a component to an overall plan.

Leverage introduces a number of key decisions about entry and exit, and emotional decisions that one needs to consider well ahead of their trade entry.

Don't book a bareboat trip with old friends to the British Virgin Islands until after profits are converted to cash.

Let's face it, leverage is tempting. For anyone who observed the run-up in shares of NUGT (Direxion Daily Gold Miners Bull 3x Shrs) - which seeks to provide 300% of the daily performance of the NYSE Arca Gold Miners Index - from $13.80 per share on January 19, 2016, to $143.24 on August 11, 2016, for a staggering 10.4 fold increase in value, visions of grandeur tend to take over as the primary strategy. After all, a 10-fold increase is enough to get anyone excited, and I have no doubt there are countless visionaries amongst us who anticipate using this course of action to capitalize on the next big run in the miners sector. Like some, I won't say the use of leverage is foolhardy. What I will say, however, is that the use of leveraged ETFs as a singular buy and hold strategy will most likely prove to be an unrealistic approach. Allow me to play the "what if" game in this article - what if I bought NUGT for the large move up as my sole approach? Before examining the answer to this question, let's first consider some facts relating to the move in GDX (VanEck Vectors Gold Miners ETF) compared to NUGT that occurred in 2016. I'll conclude with a discussion of where and how the use of leveraged ETFs in this sector might make sense for some portion of investment capital, but not all.

Regardless of how one views the Elliott Wave count for GDX or NUGT in the move up that occurred in 2016, it's fair to say they both went up a lot. GDX commenced its move up from a price of $12.45 per share on January 20, 2016, and topped at $31.80 on August 10, 2016, for a 2.55 fold increase in value. At the same time, as described above, shares of NUGT increased a whopping 10.40 fold in value. Simply put, a $10,000 investment into GDX at the low grew to $25,500 from valley to peak, and a $10,000 investment into NUGT grew to $100,400, pre-commission. Excited yet? Well, before you start planning a bareboat trip with old friends to the British Virgin Islands from the profits you realize from NUGT, first consider a few of the following observations.

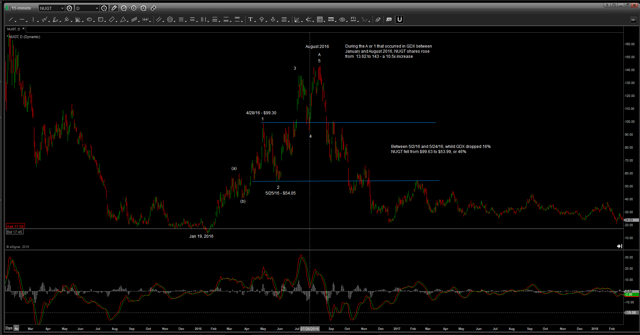

In order to have obtained this type of return from NUGT, you would have needed to enter at precisely the low and exited at precisely the high, all the time questioning where to enter and where to exit. Investing isn't just about making the right decision regarding what and when to buy, it's also about managing risk through the process and exiting in a fashion that protects gains. Take a look at the NUGT chart and assume for a moment that you entered a $10,000 buy position at the precise low of $13.54 on January 19, 2016; you would have purchased 738 shares ($10,000/$13.54 = 738 shares). Note that NUGT promptly rallied to $99.30 by April 28, 2016, taking the assumed 738 share position up to $73,283. Then, in less than 30 short days into May 25, 2016, NUGT shares fell to $54.05, taking the assumed share position down to $39,888, for a decrease in value of $33,395, or a drop of 46% from the peak.

NUGT (Direxion Daily Gold Miners Bull 3x Shrs) January through August 2016

Now, ask yourself these questions. At the time of the peak that occurred in late April 2016, as an investor who's ecstatic to see a 7-fold increase having just occurred in 4 months, would you have exited? Would you have stayed firm in the position only to watch more than half your profits evaporate in less than 30 days? Or, would you have had so much confidence from your clairvoyant knowledge of an impending move higher than you would have remained steadfast, riding a 46% drawdown with full knowledge that the march upwards and onwards will reward you over time? My guess is that during the drop, most investors would hold their position awaiting a reversal to the upside that failed to deliver in advance of the remorse that set in by having not to have exited when profits were much greater, ultimately forcing them out nearer the late May low than the late April high. Many would exit after a larger reversal down, giving back huge profits, only to re-enter again at higher levels after undergoing another bout of remorse for having exited near the low and prior to the big reversal back to the upside. We call this chasing the trade while suffering from the proverbial "fear of missing out" syndrome. Worse still, when taking a re-entry higher than your exit, where does it leave you in terms of entering your stop out level, and how much heat on the new trade are you willing to take before exiting that position? These decisions collectively result in giving back profits and are not driven by a rational approach or clearly defined strategy.

Leverage comes at a cost, and in the case of leveraged ETFs, your worst enemy is not just price, it's also time. The price of the underlying can remain flat or within a range, yet while within said range the price of leveraged ETFs will continue to drop, with share prices demonstrating degradation resulting from the daily reset of leverage within the ETF.

I think this analysis alone would cause one to conclude two things - don't attempt to buy a low or high in a sector by using leveraged ETFs, and at all times assume it is unrealistic to buy a leveraged ETF and hold for the entire move. By comparison, had one purchased a manageable and diversified portfolio of the very best individual mining shares as a core position, their inclination would have been to hold this portfolio throughout most of the larger move that occurred.

In an effort to supercharge performance through a planned approach to the miners sector, there is a place for a leveraged ETF component, but the leveraged component should represent a minority portion of the amount you would allocate to this sector (i.e. 25%) and should only be purchased to take advantage of those periods of time that price in the underlying is advancing, and strongly avoided during periods of consolidation. By holding a core position of individual mining shares through the entire move and exposing capital to leverage for shorter spans of time, one can enhance overall performance while at the same time preserve emotional currency, all the time remaining objective - no remorse, no fear, no emotionality exhibited throughout the decision process.

Here's what Michael Richards of www.timepriceanalysis.com, who according to this author is one of the most talented technical analysts and Elliotticians in the world today, says about leveraged ETFs:

Consolidations in the underlying rob investors of performance when using leveraged ETFs, and in most cases results in a loss of capital. Most stocks and assets classes spend 70-80% of their time in consolidations, with the other 20-30% of the time providing the bulk of a larger directional advance, either up or down. It is only during these advancing stages that capital should be exposed to leveraged ETF's, or said differently, the use of leverage should only come into play 20-30% of the time represented for the overall advance".

Effectively what Mike is suggesting is to identify those portions of the directional move that will occur with some swiftness, in terms of time, and expose capital to leverage only during these periods, while remaining safely in cash for the remainder of the time.

We like to use a number of tools to position into leveraged ETFs. One of the most attractive setups that allow investors to position is the classic Elliott Wave 1-2-i-ii setup, where we have identified two impulsive structures in a row, where wave 1 is the initial segment of the very robust wave iii. We also watch closely for cascading squeeze indicators to setup, whereby a one-hour squeeze triggers a four hour, which triggers a daily squeeze, which then triggers a weekly squeeze, all in the direction of the trend. The squeeze indicator measures market volatility and momentum and occurs during consolidations when Bollinger Bands move inside the Keltner Channels, where price volatility remains contracted. Once volatility starts to expand, the faster moving Bollinger Bands move back outside the Keltner Channels firing a squeeze in the direction of the trend. The use of Hurst Timing also plays an important role. By confirming a price movement over what Hurst calls the FLDs (Forward Lines of Demarcation), we're able to confirm a low in is in place, and begin to monitor for the appropriate squeeze setup to occur. Collectively, these tools when combined with a host of others allow us to identify the most appropriate time to allocate capital to leveraged ETFs, and more importantly, those times to not be exposed to leverage, while sitting safely in cash.

GDX (VanEck Vectors Gold Miners ETF) January through August 2016

As you can see, the use of leverage can be very beneficial in supercharging overall performance to a portfolio. In the context of using leverage in the miners sector, the component of capital allocated to leveraged ETFs should be relatively small, as the likelihood of holding a leveraged position for the entirety of the move would be not only difficult to accomplish from an emotional perspective but would wreak havoc on one's portfolio if they failed to leave emotion out of the equation. By holding a core position of individual miners through the entire move and allocating to leverage only at select and key portions of the advancement, one can protect their capital and supercharge overall performance at the same time. Don't be so presumptuous as to assume you'll be able to identify the precise turning point in the underlying in order to position perfectly into and out of leverage. Be sure to understand leverage is great during time periods of price advancement, but during consolidations, leveraged prices can get pummeled.